Building Credit in a Digital World

Selected Theme: Building Credit in a Digital World. Welcome to a friendly, practical space where modern tools, transparent strategies, and real stories make credit building feel doable, safe, and genuinely empowering. Subscribe for weekly insights and join the conversation in the comments.

Digital Credit 101: How the System Works Today

Credit bureaus increasingly ingest digital signals: verified rent, telecom payments, banking histories, and even employment data. Open banking connections let you share responsibly, on your terms. Comment with your questions about data sources, and subscribe for upcoming explainers.

Digital Credit 101: How the System Works Today

Payment history and utilization still matter most, but digital tools help you automate on-time payments and visualize balances daily. A reader told us automation finally stopped accidental misses. Share your own wins and follow for more practical, step‑by‑step guidance.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Using BNPL, Secured Cards, and Alternative Data Wisely

Buy Now, Pay Later can help cash flow but can fragment your view of debt. Track installments in your budget and avoid stacking plans. Have BNPL questions? Comment and subscribe for a decision guide focused on credit impact and responsible timing.

Using BNPL, Secured Cards, and Alternative Data Wisely

Start with a manageable deposit, keep utilization low, and automate payments. Credit‑builder loans build payment history while stashing savings. Share your experience starting small, and follow us for timelines on when and how to graduate to unsecured products.

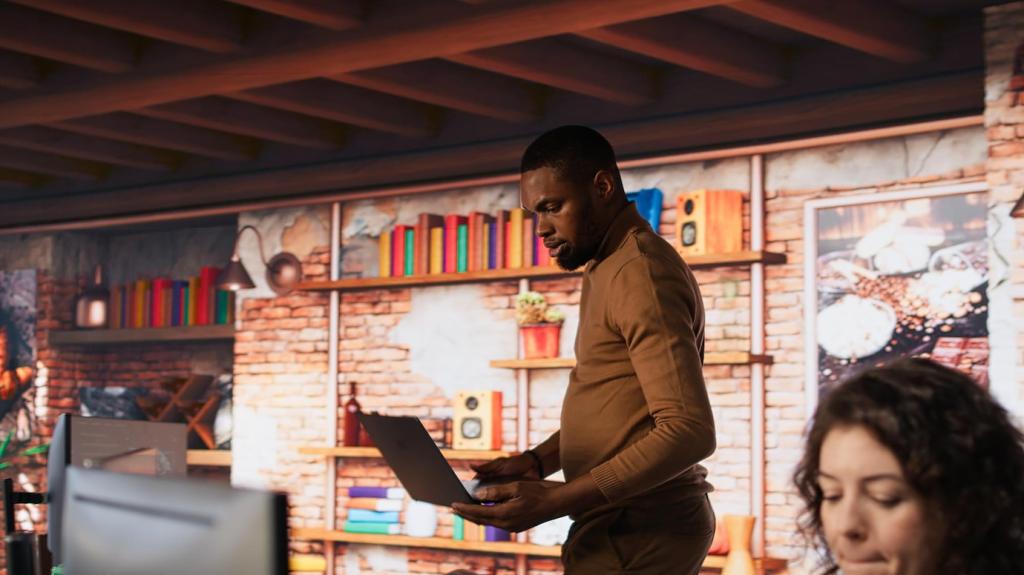

A True Story: From Thin File to Solid Score in 9 Months

They opened a secured card, turned on bureau freezes, and set autopay for minimums plus mid‑cycle paydowns. Monitoring alerts flagged a forgotten subscription. Share your month‑one priorities, and follow for our starter checklist that mirrors these exact habits.

Weeks 1–4: Visibility and Cleanup

Pull your reports, set alerts, freeze credit, and list all balances. Cancel unused subscriptions and schedule autopay. Comment when you complete these steps, and follow for a gentle, supportive email sequence that keeps the momentum steady without overwhelm.

Weeks 5–8: Build, Automate, Optimize

Add a secured card or builder loan if needed, refine utilization targets, and automate mid‑cycle payments. Track trends weekly instead of obsessing daily. Share your optimizations below, and subscribe for optimization worksheets tested by our community members.

Weeks 9–12: Scale and Safeguard

Expand rent or utility reporting, review permissions, and rehearse fraud response steps. Set calendar reminders for quarterly checkups. Tell us your finishing wins, and join our list to receive ongoing checklists that keep your digital credit growth resilient and calm.